Here’s a preview of what we’ll cover this week:

Macro: Tariffs Incoming - April 2nd , Inflation Expectations, Chips Act

Market: Investment Philosophy, Investing in Social, META & 13F, Consensus Trap, Earning Estimates Slashed, Self-Driving Breakthrough

AI: France's AI Bet, DeepSeek usage, Europe's Data Boom

Lumida in Spotlight

In this episode, hosts James Seyffart, Alex Kruger and Lumida CEO, Ram Ahluwalia, sit down with Sal Ternullo, managing partner at A100x Ventures, to break down the questions of the day.

To catch our own podcasts timely make sure to subscribe to Lumida Non Consensus Investing!

Ram will do another quarterly 13F review - breaking down the moves and thematic positioning of investors including Druckenmiller, Point 72, Altimeter and others.

He will also share the ideas he believes are worth pursuing and which managers he believes have real skill

First Things First

What a Week—Markets Keep Defying the Narrative.

The speed of information—especially around policy, geopolitics, and the data center theme—has been extraordinary. Every day, I jot down notes for the next podcast, and within 24 hours, they’re already outdated. A full recap? Impossible.

The good news: processing information efficiently and adapting quickly is an investing edge. And right now, we have a strong read on the situation.

Take tariffs. For weeks, Mr. Market panicked whenever Trump mentioned universal tariffs. But this past week? Markets rallied on news of bilateral tariffs. We’ve been saying for a while that tariffs, if structured correctly, aren’t about raising revenue—they’re about breaking open foreign markets. And it’s already happening.

Example: After Trump’s meeting with India’s Prime Minister Modi, we’re already seeing tariff cuts on American automobiles. The worst of the tariff fears appear to be behind us. Trump is prioritizing economic growth over tariffs as a revenue source, and Mr. Market has caught on—hence the rally. Expect names that were punished for tariff exposure (auto firms, retailers importing from China) to rebound.

I strongly recommend listening to Trump’s Thursday press conference. He covered everything except UFOs.

Markets Back at All-Time Highs

Remember when Chamath freaked out on the All-In podcast about Mag 7 weight in the S&P 500?

We’re at all time highs.

None of it mattered.

Nvidia was in the $116-$118 range. Now? $138.

Nubank is up 20%.

Uber is up 20%+.

Meta—our Lumida Stocking Stuffer pick—is up 26% YTD. It’s rallied 20 days in a row. (For context: the S&P gained 24% all of last year.)

AppLovin rallied 30% after earnings. We bought in June and August last year when it was trading at 13x PE. The market mispriced it. We didn’t.

Bottom line: The consensus keeps overreacting. If you’re paying attention, opportunities are everywhere.

Animal Spirits Are Topping Out Soon

Overall, I believe we are seeing signs of a blow-off top in Animal Spirit type names unfold.

We introduced this concept in last week's newsletter - the Bubble in Quality.

So far, we have not seen a full breakdown in animal spirit leaders like Palantir. As we noted last week, you need to wait for a large red candle and stay on the train until then.

Then you pay your dues on the way out.

Markets are now headed into a period of negative seasonality and no real newsflow until we get to Nvidia earnings.

Further, on Thursday, we had a rally on Trump’s discussion of a ‘Global Peace Dividend’ and nuclear de-escalation with Russia and China.

(Lutnick struck the right tone around tariffs and emphasized other parties can lower them by reciprocating - that’s the right message.)

We also saw last Thursday another marker of these ‘peak sentiment’ type moments when all the indices were in the green. Naturally, Friday most indices were down.

We’ve seen this pattern play out in 3 or 4 of the last several weeks have we not?

Remember CRISPR - that genomic editing stock that loses money year after year?

It had a massive one-day rally on high volume.

You can look at quite a few stocks: BFAM, HOOD and even Iridium (IRDM) which we bought going into earnings and you see a lot of these “squirts”.

I could tell you a similar story for many other ‘story stocks’.

Here’s a “squirt” in ARKG - an Ark Invest ETF loaded with bad biotech companies:

These are short driven covering moves - that’s why you see the high volume and gap ups.

I expect sometime this week we may see these pull back and the hot air deflate in speculative names.

That said, 13Fs just dropped and will see immediate buying of names from popular hedge fund managers.

In fact, we saw that this past Friday where airlines names owned by Druckenmiller went up 3%.

On a sector basis, both financials and healthcare the two best performing sectors year to date. These are the categories we’re overweight in and have focused on for several months. However, we expect healthcare could face some near-term weakness - that would present a potential re-test and opportunity to add to positions.

The housing category is under significant pressure. This category has weakened considerably ever since mortgage rates broke thru 7%+.

You might recall several months ago we noted that risk factor.

We chose not to sell then, although we highlighted the risk, to avoid paying taxes. In retrospect, we would have been better off selling and paying the tax.

We think certain names in the housing sector, such as M/I Homes (MHO), are an attractive buy here.

One name we like in the healthcare space as an attractive buy is Biote (BTMD). This is a name on the Lumida Stocking Stuffer list.

They changed out members on the C-Suite. That appeared to send the stock lower. Additionally, revenue came in somewhat softer than guidance last quarter due to hurriances.

The new CEO formerly was the Chief Commercial Officer for diabetes treatment company Insulet (PODD). That’s strong.

And the stock now we believe presents a favorable entry and has a 5.7x forward PE with a Return on Invested Capital of 80%.

They provide clinical delivery of Hormone Replacement Therapy. Many healthcare stocks are off due to RFJ Jr policy risk. (Pretty sure that guy is taking Testosterone Replacement Therapy.)

Simply put, Biote is a classic compounder story. They need to recycle free cashflow into new ‘stores’. That grows earnings. Repeat.

The stock has freecash flow and earnings growth. It is a mispriced asset in our opinion.

(This is another reason why we are assessing demand for a Lumida ETF at www.lumidaetf.com. An ETF can do an ‘in-kind’ transaction and not incur capital gains tax, very similar to how real estate investors can do a 1031 exchange and avoid capital gains.)

If you look at markets from a sector perspective, you can see tech and financials are overbought. Nothing is on sale.

We believe now is a good time to play defense.

Speaking of defense, take a look at the defense sector.

The XAR Aerospace & Defense and ETF is up 25% - roughly the same as the S&P - but with much less volatility.

Trump on Thursday said his goal is to cut defense spending 50% by working out a grand deal with China and Russia to cut nukes and other spending cuts.

But for the newsflow, this ETF looks like it has an attractive entry point.

We are going to wait a week or two to see how the news settles. Less defense spending means less earnings.

On the other hand, we are doubtful Trump will be successful in cutting defense spending anything close to 50% (even it is a good policy objective).thing is on sale.

Airlines

An area we are spending more time on is the airline category. We believe airlines could perform like cruise lines as consumers continue to stretch their legs and spend on travel.

Take a look at the JETS ETF:

The earnings from last quarter was strong.

The forward PEs are around 7 to 10x - much cheaper than the broader market - but expensive by the categories historical standards.

Druckenmiller we noticed also bought airlines sometime in the last few months.

We have two ideas we are researching and will share more in the future.

Semiconductors

In semis, we believe sticking with the market leaders - Nvidia, TSM, and ASML makes a lot of sense.

We bought ASML in recent weeks and TSM. They aren’t exactly on sale, but Taiwan Semiconductor at 17 to 18x Earnings is ‘interesting’.

Trump is critical of Taiwan (incorrectly in our view) for ‘stealing’ the U.S. semiconductor industry.

TSMC will not get tariffs. That would hurt American innovation.

It’s hard to get a good buy on a name like this - we believe now is a reasonable time to get some exposure to a clear leader and monopoly in the foundry sector.

This is a name we owned last year but sold when the semiconductor category went parabolic.

Macro

Tariffs Incoming

I recommend you listen to it twice if you are an investor.

Topics: Defense spending cuts, pharma, European Union, Russia / Ukraine

If you are wondering why markets are up despite tariff talk, here is why below

Starts likely on April 2nd

Visit our website to learn about our ETF and let us know your interest.

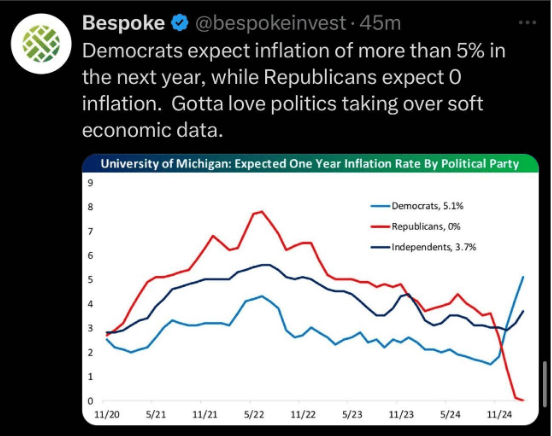

Inflation Expectations Divide

Chips Act

Trump made a direct request to TSMC to move production on-shore.

This move was cheaper and far more effective than the waste that is the CHIPS Act, isn’t it?

An easy way to save money?

Scrap the CHIPS Act.

There’s no reason Intel, Global Foundries, Texas Instrument and other semis need US taxpayer subsidies.

Focus instead on onshoring the Taiwan Semiconductor supply chain and robotics / drones supply chains. That means incentivizing much smaller firms that create small component parts – not big corporate welfare deals.

Reach out and learn more! You can book a session with Marc, our client advisor, on his calendly.

Market

Summary of My Investment Philosophy

One of our picks from last year, App Lovin reported earnings and went up 30% on the news.

This has been a multi-bagger in less than a year.

Here’s a snippet from a client account to show the gains are real, and if you want to learn more about our services you can speak directly to our existing clients for a referral.

Breaking it down - here is the framework:

1) Multiple expansion. We want to find names where the multiple can expand.

2) Earnings Growth. We like profitable companies that can grow earnings.

3) Variant Perception. We like to find a name that is overlooked by the market perhaps due to a misperception.

This Non-Consensus framework runs rent free in my mind.

We saw APP in June of 2024 - and no one on the team could explain why it has a PE of 13x.

For weeks we were struggling to find the bear case. Then we pulled the trigger.

I usually have no idea price target per se but a clear sense of upside vs downside.

And we like to cut losers like SMCI PAGS or REGN quickly.

I believe you can be right only 60% of the time and do very well if you apply this approach.

You are pulling weeds and watering flowers as Peter Lynch 🐐 used to say.

That’s essentially what big quant funds are doing except over thousands of securities.

Be the casino, not the player

We also seek to generate ideas better than what we own all the time.

Those ideas are competing for capital.

That forces extremely tough trade-offs.

And those ideas are from different industry groups and factor exposures.

When you are forced to sell something you love for something you don’t own, but want to own, it sharpens the mind.

That activity of continuous research and competition of ideas levels up the portfolio.

At year end, I hope to create audited returns so you can judge for yourself.

Request: If you know of any firm that can do a GIPS compliant audit of Schwab for SMAs I would appreciate any introductions.

Also, help me get to 500 fills at: Lumida ETF

Covid and retail brokerage has transformed investing.

I track a basket of popular retail stocks.

Their movements cannot be explained by their factor exposures.

Incidentally, one of the ways I bet on this trend is by owning $VIRT

They are a market maker led by Virtu CEO Doug Cifu.

I expect that market makers will do quite well with the heightened volatility, proliferation of ETFs, and liquidity needs that retail trading brokerages have.

Fun Fact:

I had a fun interview with Doug last year.

Before the show I asked him 'Why is your stock only trading at 5x PE?'

One year later the stock is up 127%.

Forward PE still only 9.8x

Much cheaper than its capital markets comps with better performance.

However, the capital markets theme is under pressure right now (See Jefferies, Evercore, Nasdaq, and CME group, etc.) so you could wait a bit or consider a partial position.

Reach out and learn more! You can book a session with Marc, our client advisor, on his calendly.

META & 13F

Guess what the #1 name in my hedge fund 13F tracker was last quarter?

META

What happened since everyone knows.

I was relistening to the 13F analysis from last quarter

With the benefit of hindsight, this was absolutely dripping with alpha and actionable

I have at least 10 ideas coming out of this drop

Our team has been cranking on 13F idea gen since Friday night

What is your wealth manager doing?

Earning Estimates Slashed - Again!

Analysts have been slashing forward earnings estimates.

That's not good over the next few weeks.

It does set up easier beats later in the year though.

(This pattern seems to happen most years, and around February for some reason.)

Wondering what to do next? Book a session with Marc, our client advisor & explore the world of wealth management further.

Consensus Trap

Right is Wrong

Bank of America just removed The Trade Desk from their “US1” list - their selection of their best stock picks - after it dropped 30% after earnings.

The US1 list is formed by a committee and it does an amazing job of lagging the S&P 500 over long periods of time.

Committees produce Consensus.

Self-Driving Breakthrough

Google CEO Sundar Pichai says self-driving cars are now working, with 78% fewer injury-causing crashes than human drivers, and Waymo are now looking to scale up the rollout to countries around the world.

AI

France's AI Bet

DeepSeek usage

Europe's Data Boom

Digital Assets

Tudor Jones just loaded up on Bitcoin.

His firm quadrupled its stake in BlackRock’s IBIT ETF. That’s conviction.

High Yield Laughs

Elon & his X games top the humor charts for this week.

But of course we can’t miss out on chip fun!

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

As Featured In