Welcome back to the Lumida Ledger. Here’s a preview of what we cover this week:

Macro: Jackson Hole Takes, Housing, CRE Train Wreck

Markets: Hedge Fund 13F Tracker, Tactical Markets Call

Company Earnings: Nvidia, Snowflake, Dick’s

AI: Cyber Fraud Uptick, AI Takes from Two Sigma Ventures

Digital Assets: Bitcoin Futures Unwind, Tokenization, Upcoming Catalysts

We enjoyed this conversation with Marc Weill from Two Sigma Ventures.

We discussed the big trends, non-consensus investing, health and longevity.

Give it a listen here if you have interest in any of these topics.

It’s conference season. We’ll be speaking at Permissionless (Sept 11-13 in Austin) and Messari Mainnet (Sept 20-22 in NYC). Lumida has you covered on ticket discounts.

Blockworks Permissionless: use code LUMIDA30 for 30% off your ticket

Messari Mainnet: use code MAINET-SPKR for $300 off your ticket.

Macro

Fed Chair Powell gave a widely anticipated speech at Jackson Hole. Unlike last year, there was no mention of the word “pain”. On account of that, markets closed higher for the day.

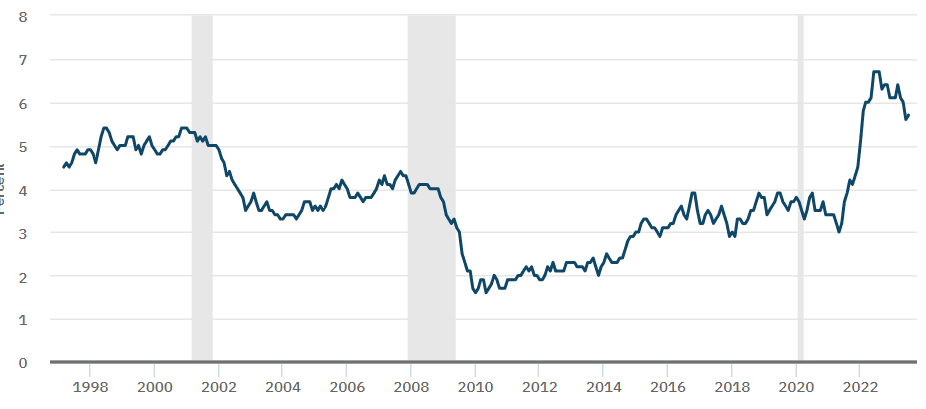

Powell highlighted wage inflation in the services sector - still running hot at 5%. Recall from our prior newsletters that service wage are the last pillar on the inflation stool. We may see no rate cuts in 2024, we aren’t there yet.

Atlanta Fed Wage Growth Tracker

Interest rate futures are pricing in a 50% probability of a rate hike before your end. The key will be the August CPI report which hits on Wed Sep 13th.

Here’s a thread on our Jackson Hole readout for more color.

New residential home sales +31.5% yoy and +4.4% m/m

Despite soaring mortgage rates, the U.S. home-building sector remains robust.

July new home sales are up 714,000, up 4.4% from June and +31% from the year prior.

Warren Buffett made investments in three publicly traded home builders this past quarter.

We highlighted this homebuilder that David Einhorn (Greenlight), a well known value fund is accumulating. The technicals on homebuilders look bad right now, but this stock certainly looks like a great way to bet on the housing shortage on some of the best growing states in the Union: Texas and Florida.

The stock has a mid-teens earnings growth, a PE ratio of 7, is up 90% YTD - beating everyone in the Magnificent 7 except Nvidia.

Read this thread for more.

Commercial Real Estate Slow Motion Train Wreck continues

I've seen this movie before in the aftermath of the 2008 Crisis.

The big money was made not on the big short.

It was the "Big Long" - buying out-of-favor assets from banks that were non-economic sellers.

The banks were forced sellers then and they are now as deposits experience a 6 to 8% drawdown across the banking system. Big PE firms are lining up warchests to feast on the opportunity.

The returns will not be as good as post-GFC - back then you could buy bonds trading at 10 cents on the dollar that “pulled to par”.

But, I believe they will still be measured in 'Xs'. We believe a good manager will generate 3X based on our analysis.

Our return expectation is informed by the on-the-ground deal-by-deal underwriting we see taking place in our manager conversations.

Here’s one example from the WSJ: “The owner of a downtown San Francisco office tower unloaded the property for $41 million to developer Presidio Bay. The seller, Clarion Partners, had purchased the property for $107 million in 2014."

That buyer picked up an asset for less than 40 cents on the dollar.

How to pursue it?

The wrong way is to focus on competitive markets (DTLA, NYC Office, or SF). Also, avoid large deal sizes. There's too much PE money focused on these markets so assets are auctioned off efficiently.

The best way is focusing on secondary and tertiary markets and smaller deal sizes (say, $10 to $25 MM asset value), and source from community banks.

Remember, banks primary lending activity is CRE lending.

A single family office we spoke to picked up a 12.5% cap-rate Class A office in Minneapolis from Brookfield. That will be a 3x return after depreciation.

And they will likely be able to do a “cash out refinance” when community banks stabilize in a few years. That means investors will receive cash that is non-taxable which may well reflect the acquisition price of the asset. That’s one example of the favorable tax treatment for investing in real estate.

Every 10 to 12 year there is an opportunity to pick up real estate and benefit from the mistakes of others. This is one of those times.

We view this as an ‘anchor position’ due to our expectation of an attractive risk-adjusted tax-efficient return with limited downside.

Our preferred manager will stop accepting new investments at the end of September.

Reach out if you are a QP or Accredited investor and want to learn more.

Markets

You may recall we issued a tactical underweight call on August 1st.

Well, we’re a month into it. What’s our view now? We believe we are in the back-half of the correction timewise.

It’s important to keep in mind that a significant amount of bad news is priced in.

Somewhere between now and October timeframe we expect we will be fully invested. We’re taking it day by day.

Today, the Dollar is moving up, semiconductors and homebuilders are pointing down. We want to see those assets improve.

The CPI print on August 13th is the last major data point that could have downside if there’s a hot print. We believe there are better than even odds of a negative inflation surprise over the next 3 months.

On the bright side, as we approach October, the big Wall Street strategists will issue FY ‘24 earnings estimates. We expect that will create market lift.

Equity markets are fundamentally about earnings growth.

We believe there are opportunities now to start legging in.

We picked up Dollar Tree for the Tactical Portfolio this Friday after their stock dropped 20% after earnings. Statistically the stock is up 8 out of 9 times over the next 1 month with an average gain of 7 to 9%.

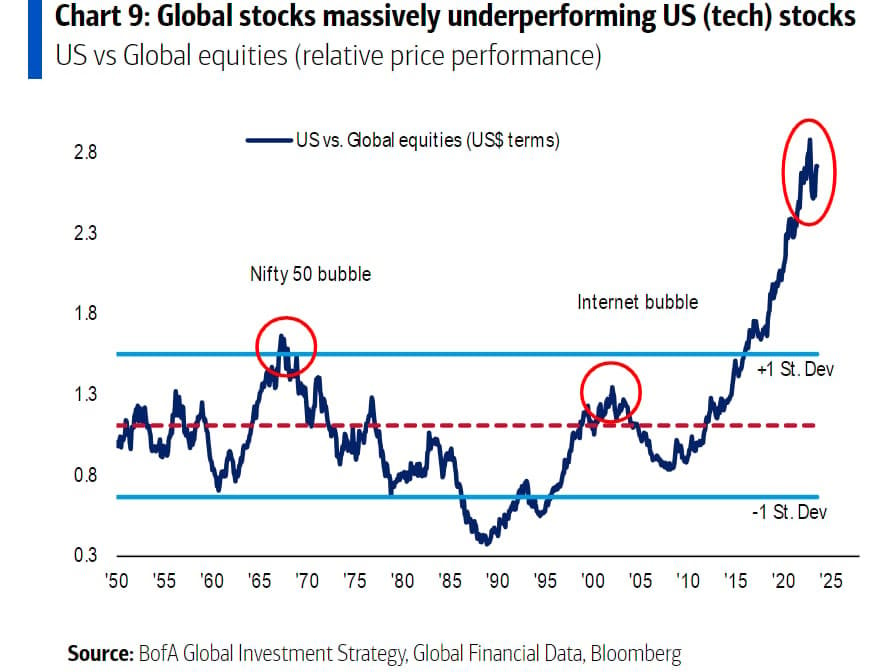

Equities in the Eurozone area are cheap. And the US has outperformed global equities by 2.5 standard deviations. As you can see below, this is a mean reverting timeseries.

There are a number of high quality businesses in the Eurozone for conservative investors (think UBS, AstraZeneca, Nestle, etc.) and for growth investors (think names like Novo Nordisk, Global Foundry Services).

Within Big Tech valuations are elevated.

So make sure you get your money’s worth when you are investing in a growth stock. We prefer to tilt towards Big Tech names that are actually growing earnings at attractive rates. Here’s a table showing valuations of BigTech firms alongside earnings growth estimates.

If you’re going to own a growth stock, make sure it’s growing!

To that end, we like tilts towards Nvidia, Google, and Amazon. Underweight Apple and Netflix.

We like Direct Investing so we can tax-loss harvest and the individual level and avoid paying ETF expense ratios. Studies show that the tax alpha from Direct Investing is 1%. Combine that with not having to pay ETF fees to BlackRock or Vanguard and it’s a great opportunity.

Reach out to us to learn more about our model portfolios for conservative investors, and also for growth oriented investors.

Remember, the best time to invest is when the fundamentals look dour and sentiment is poor. You want to sell, or reduce weight, when everyone is euphoric.

We have a ways to go in this bull market.

Summary of our Views

We continue to like the banks (ex-regionals) and energy stocks.

Don’t look now - the energy sector is up 17% in the last few months and is up for the month of August.

We also like ‘nuclear renaissance plays’ in the energy sector.

We continue to like the Silicone layer. Last weekend we wrote we expect Nvidia to beat (revenues), beat (earnings), and raise (guidance).

That’s exactly what happened.

There are good names in the Semiconductor space that have lower valuations than Nvidia but good earnings growth trajectories. We are doing homework on Snowflake, Broadcom, VM Ware and others.

This semiconductor thesis remains non-consensus. We can see that in our hedge fund 13F tracker. We find that only David Tepper (Appaloosa) and David Goel (Matrix Capital) had a number of bets on semiconductors.

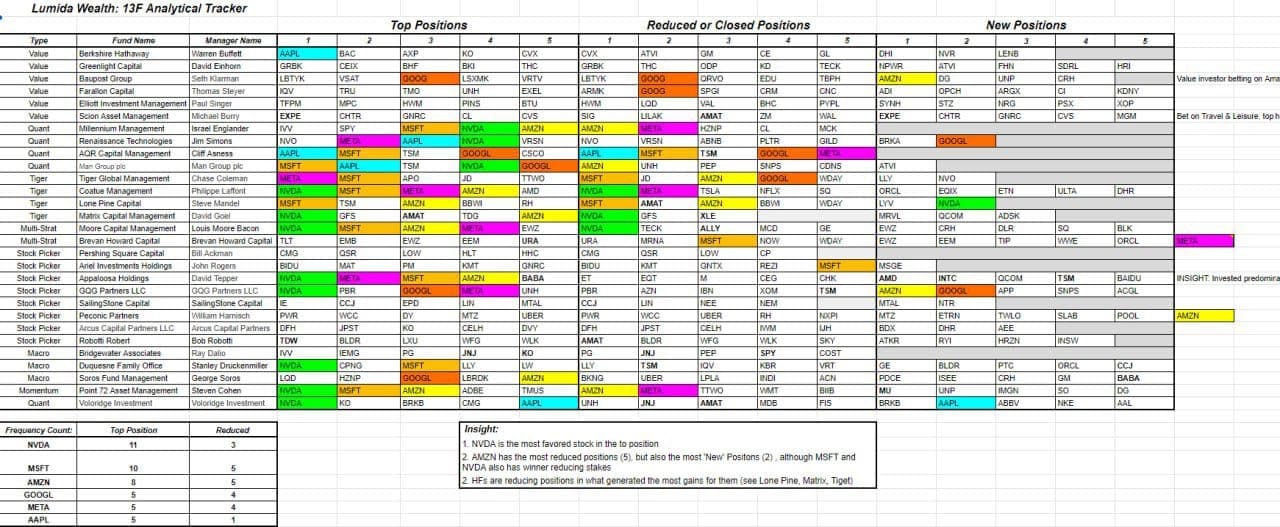

What are the Big Hedge Funds Doing?

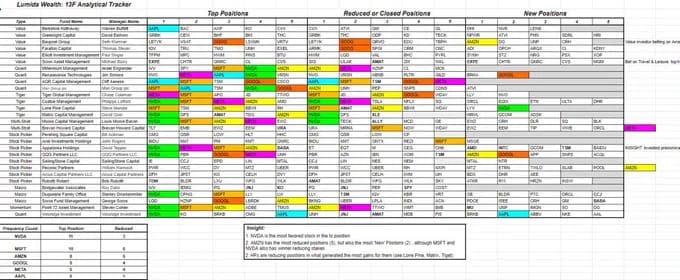

Lumida released this past Tuesday a first-of-its kind 13F tracker.

Here’s a thread we wrote with specific conclusions.

We study the moves of the 30 most iconic HFs: Bridgewater, Druckenmiller, Soros and more.

We’ve never seen a research firm publish a study like this. We believe the insights on positioning and idea generation are invaluable.

13Fs are great for idea generation - especially when you know of skillful sector specialists that know a sector inside and out.

In fact, that’s how we approach BioTech investing - thru a specialized manager with a 10-year track record of out-performing the BioTech index and the S&P 500.

You may need a cup of coffee and reading glasses to fully process this. If you are an investor, the insights are worthwhile.

Lumida 13F Tracker

Investment Tip: Although we spend time identifying the big trends and watching the big market cap names - real investment returns are from identifying small cap growth stocks that are quietly compounding earnings with a real moat.

We included several strong managers with evidence of stock picking skill above. These are managers that don’t have recognized brands and you won’t find on CNBC.

Nvidia

There it is folks. Nvidia did a Beat, Beat, and Raised guidance.

That was our call in the Lumida Wealth newsletter last weekend. Decrypt gave us a nod.

Nvidia shares climbed 8% in extended trading. Nvidia said it expected third-quarter revenue of about $16 billion, higher than $12.61 billion forecast by Refinitiv. That's a massive beat.

Nvidia’s guidance suggests that its sales will grow 170% on an annual basis in the current quarter. The driver is data center revenue (e.g., spending from Big Tech and private clouds).

A few takeaways:

The Hedge Funds in our 13F analysis were correct

We like Nvidia because we are acting on the knowledge that the Silicone Layer is benefitting from AI. We saw that in the CapEx from Big Tech earnings

What we did not see in BigTech Earnings was revenue/earnings from AI

Our high-level thesis on Nvidia is this:

Big Tech is competing for the new ‘form factor’. Mobile was the last form factor.

Whoever catches the ‘'jump ball' and nails the form factor captures a massive prize. Much in the same way how Apple stole the crown from Microsoft’s disastrous Mobile Me. Microsoft stock went nowhere for a decade in the 2000s.

So, Big Tech is pouring billions of dollars in the AI bet in a competitive race.

The unambiguous beneficiary is Nvidia.

The smart way to play this, however, is to start focusing on Nvidia's semiconductor supply chain and infrastructure providers.

Nvidia’s earnings call was insightful. The CEO also rattled off key partners - VM Ware (getting bought by Broadcom), Snowflake, and others.

As we mentioned earlier, these names and others (Cloudflare?) are less well-known and are cheaper than Nvidia but may be linked to the same underlying growth trend.

These are names worth studying further.

Company Earnings

Company Earnings give us insight into sectors and trends. And they are not subject to revisions.

Indeed, our call on beat/beat/raise call on Nvidia was based on the CapEx trends we saw from our myriad BigTech earnings deep dives.

So here are highlights from some other names

Snowflake’s growth is strong and also linked to the AI trend. We are also a fan of the CEO Frank Slootman who wrote “Amp It Up”. Some key stats:

Q2: $674MM in revs, Product revs: $640MM

Revs up QoQ: ~8.1% and ~37% YoY

CEO Frank Slootman underscores the vital link between a strong data strategy & AI/ML success, positioning "Snowflake as the global epicenter of trusted enterprise data”

402 customers have >$1MM trailing 12-month product revenue (smooth not chunky rev mix)

Adjusted free cash flow of $88MM, a 50% YOY growth

Dick’s Earnings had a triple miss. Missed revenue, earnings, and guided downwards. DKS was down 24% on the day of the report.

So how do we reconcile the triple miss from Dick’s Sporting Goods with strong GDP now and leisure spend?

We believe people are browning locally and then shopping online at Amazon for the best price. Amazon is testing same-day delivery service which is also driving more spend on Amazon.

DKS revenue declined YOY at 1.8%. Statistics like that should give you pause. The Consumer is strong and is spending time outdoors - and yet spend is declining YOY?

We saw this at Apple and Disney… Consumer behavior is changing.

Lowe’s Earnings: Lowe’s experienced strong sequential quarter revenue growth of ~12.1%. That statistic lines up with the data on housing permits and a 5% GDP now figure. Lowe’s is also launching same-day delivery - they are afraid of Amazon.

AI

We spent time talking with Marc Weill, a partner at Two Sigma Ventures, about AI.

We recommend listening to that or last week’s video session. That’s a long shelf-life and will give you the best perspective on how to approach investing in AI in public and private markets.

This article stuck out to us. Deep fake scams are on the rise.

We called out Cybersecurity (both venture and public markets) as an indirect way to bet on the rise of AI without paying nosebleed valuations.

The promise of AI is real, even if it is taking time to get to launch mode.

AI continues to make advances in healthcare.

Researchers have created a brain implant that decodes thoughts into synthesized speech allowing paralyzed patients to communicate through a digital avatar.

The implant converts brain signals into text at nearly 80 words per minute.

The AI generates realistic vocals (mirroring a patient’s pre-injury voice) and facial animations that aim to enable more natural communication.

The breakthrough brings the tech closer to real-world use.

The next step being a wireless model that doesn’t require a physical connection to the interface.

Restoring communication for those with paralysis is an innovation that would change countless lives.

The future is bright friends. We are interviewing healthcare venture managers in the AI space that are valuation sensitive. Stay tuned for more.

Digital Assets

Last week’s digital markets crash wiped out $3B of leverage from the Bitcoin Futures market, as Alex Thorne from Galaxy Digital pointed out in his report on Bitcoin Markets.

Liquidations and declines in speculative open interest are bullish.

It’s possible Digital Assets bottomed after the liquidation events last week.

We also picked up ETHE the Friday before that at the close at entry price of $10. Bitcoin and Ethereum are holding up nicely.

If we can get better entries, we’ll deploy again. If not, we’ll wait and ride our positions higher. Our timeframe is multi-year, not quarterly, so we can ride out the volatility.

But, regardless, we believe increasing allocations at current price levels through Discount to NAV securities is a good idea.

We have structural tailwinds with the halving cycle, tokenization and institutional adoption as catalysts.

We spoke to Matt Homer, former regulator at NYDFS and FDIC, and founder of early stage venture firm ‘Department of XYZ’. We discussed digital assets regulation, Ripple’s decision, Fintech, venture markets & more.

Work with us: we are are looking for a junior offshore analyst to help us build more analytically-informed content. Send referrals here.

Conference Calendar: We’ll be speaking at Permissionless and Mainnet. We have promo codes for discounted tickets. Reach out to us if you are attending and would like to connect.

Permissionless Sept 11-13 in Austin. Use code LUMIDA30 for 30% off your ticket

Messari Mainnet Sept 20-22 in NYC. Use code MAINET-SPKR for $300 off your ticket.

Meme of the Week

Anyone know a good private wealth manager? Asking for a friend.

Quote of the Week

"The investor's chief problem - and even his worst enemy - is likely to be himself." - Benjamin Graham

If you enjoy the Lumida Ledger, please forward share with a friend or subscribe.

If you’re interested in learning more about Lumida’s wealth management services, please join our waitlist.

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.