Here’s a preview of what we’ll cover this week:

Macro: How’s The Economy?

Markets: There Were Signs; The AI Apocalypse Trade; Hubspot Earnings; Investors Are Positioning For Cash; More Trouble For OpenAI; WSJ is the contrarian Indicator; The Bubble In Venture Capital; Trading As Gambling?

Lumida Curations: The AI Ads Debate Goes Public; AI Agent “Taught Itself” a New Skill; Olive Oil Is the Anti-Inflammation Hack

Spotlight

This week, I met Angelo Robles to talk about the end of the KOL-driven trade and why high-conviction tech and crypto portfolios are getting repriced.

We also discuss the rotation out of U.S. mega-cap leadership and into international markets, banks, and value.

Here’s what we cover:

The decline of U.S markets versus rest of the world.

Banking as an attractive investment sector.

Why Bitcoin trades like the high beta, and reasons behind near-term weakness

Investment themes - nuclear renaissance, biotech, semiconductors/AI.

Public market opportunities related to AI advancement.

Our predictions on the top 10 global companies in 5-10 years.

Watch the full podcast here.

ANTHROPIC CAPEX BUST?

The CEO of Anthropic is as delusional as Sam Altman.

He is projecting $1 Tn in revenue by end of the decade and 10% GDP growth.

The promise of AI is real… but this thought process betrays a lack of understanding.

S&P 500 CFOs are not going to tank their earnings and fork over $1 Tn to capex spend.

They see what happens to their stock price. And, Dario ignores the power of price competition in these LLMs that have no real moat.

I thought maybe it was Sam Altman having an ego complex.

No, this is industry wide delusion. And, it squares with our view that private venture capital markets are in a major bubble.

I did a 3 part twitter thread discussing Dario’s interview, and its implication on the broader market. I recommend reading it here. I

Mag-7 Go Capital Intensive

This week, Alphabet raised $20 Bin its biggest-ever U.S. dollar bond sale. The issue was upsized from $15B and drew over $100B of orders.

Google is also lining up issuance in Switzerland and the UK, including talk of 100-year bonds.

Google needs this financing to fund its $180B capex plan in 2026, and ahead.

Overall, the Mag 7 are going from capital light model to capital-intensive.

The balance sheets that used to be “pristine” are getting levered to buy compute.

Hyperscalers went from using around 30% of their OCF in capex to an expected 92% in 2026.

Capex is tricky for stock performance.

You have an outflow today that will have a possible return in the future.

Even if the ROI is good, the market has to sit through the cash burn first.

The uncertainty is discounted heavily if markets fear the returns will be lower than expected (as the case is today).

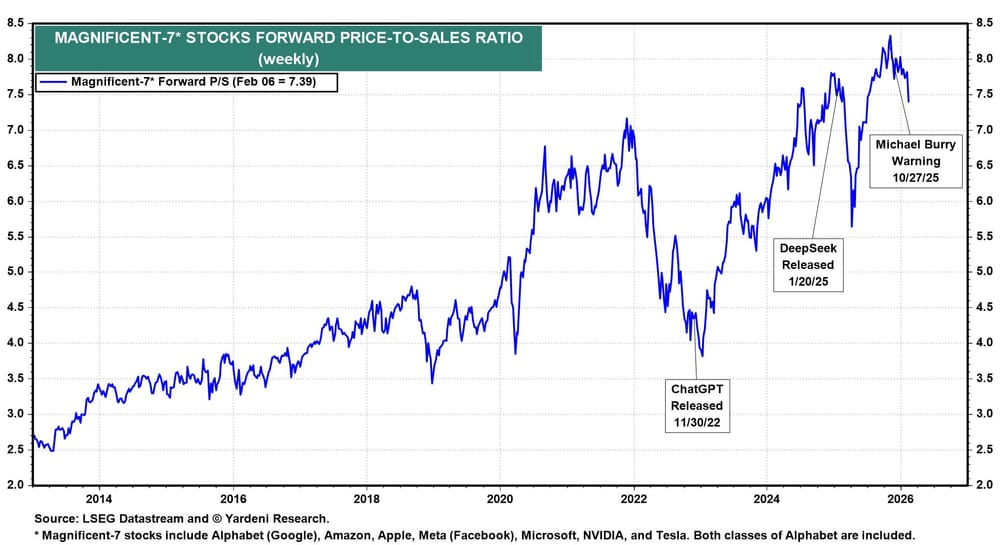

Market sentiment has turned weaker for the Mag-7 in the last couple of months.

They have underperformed the benchmark, and are down 4.25% in the last 3M.

But, from hyperscalers’ perspective, the capex is fully rational.

You can’t “wait and see” in the AI model race.

Your target is to be #1 or #2. Falling to #3 puts the core business at risk.

Hence, spending $150B in CapEx to protect or grow a couple trillion of market cap is rational.

It is a positive expected value decision. You spend to stay relevant.

However, the risk is overinvestment – a movie we have seen before.

Housing in 2006–08. Dark fiber in dot-com.

When everyone builds at once, you can create excess capacity.

Even the “obvious” winners can correct when the trade gets crowded. Fundamentals can be right and the stock can still be wrong on timing.

This is why we are seeing the broadening reaction in markets. The capital is rotating from Mag-7 into value and international plays.

Take a look at Google’s chart… showing weakness after winning the Consensus AI crown.

Side note: this corporate re-leveraging is going to keep rates higher for longer.

Sovereigns are already highly leveraged post-2008. Inflation is sticky. Long rates are already elevated.

We remain of the view it’s time rotate away from bonds, and into high value, cash generating stocks.

I did a FSD stream this week, titled ‘Mistakes were made’, discussing the near-term markets volatility, the outperformance of bond proxies, vix decay and how to position in current market regime. Watch it here.

You Only Eat After Tax Returns

This was a beautiful email for a client.

Wealth management is not unlike a physician practice. Instead of tending to health, you are tending to wealth. We take great satisfaction in helping our clients acheive their goals.

Raymond is a Lumida licensed advisor who left UBS and Fidelity. He wanted to be a part of the trend to modernize wealth management.

I love client emails like this.

‘I felt trapped in the position… I didn’t want to sell… high marginal taxes. Thank you. You saved my ass.’

We had a new client join recently.

They had a boatload of unrealized gains.

We helped them exit and keep more of their hard earned wealth.

Remember, you only eat ‘after tax’ returns.

Now, this client has more to save for his retirement, his kids’ education, and his family’s future.

They are one step closer to living the life they want to live.

You can sign up for our wealth management services, where we optimize for after-tax returns. Schedule a free consulting call here.

Macro

How’s The Economy?

This week’s data releases show US economy is on a solid footing.

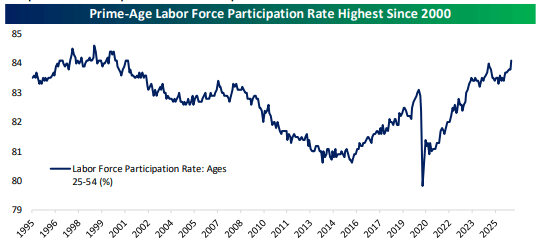

Labor market data came in stronger than expected.

January payrolls rose by 130,000 versus expectations of 65,000

The unemployment rate ticked down from 4.4% to 4.28%

Interestingly, this happened despite the highest labor force participation since 2000. This shows hiring is gaining momentum.

Businesses are confident in the economy, and are ready to invest more.

Q4 earnings support the thesis.

84% of companies have performed better on revenues than analysts' estimates, and 70% have beaten on earnings.

This outperformance is even more remarkable considering it came after upward revisions during Q4’25.

The other major economic gauge is inflation - it also came in better than expected.

Inflation was 2.4% YoY in January, coming in lower than Dec’s 2.7%. This was the lowest inflation print since 2021.

Productivity growth through AI and automation are helping higher output at a lower cost. This reflects in net margins reaching all time highs.

We can expect productivity to go higher from here, as AI is implemented on a wider scale.

Overall, we have a resilient labor market, positive earnings surprise, and lower inflation - what else would you expect from a healthy economy?

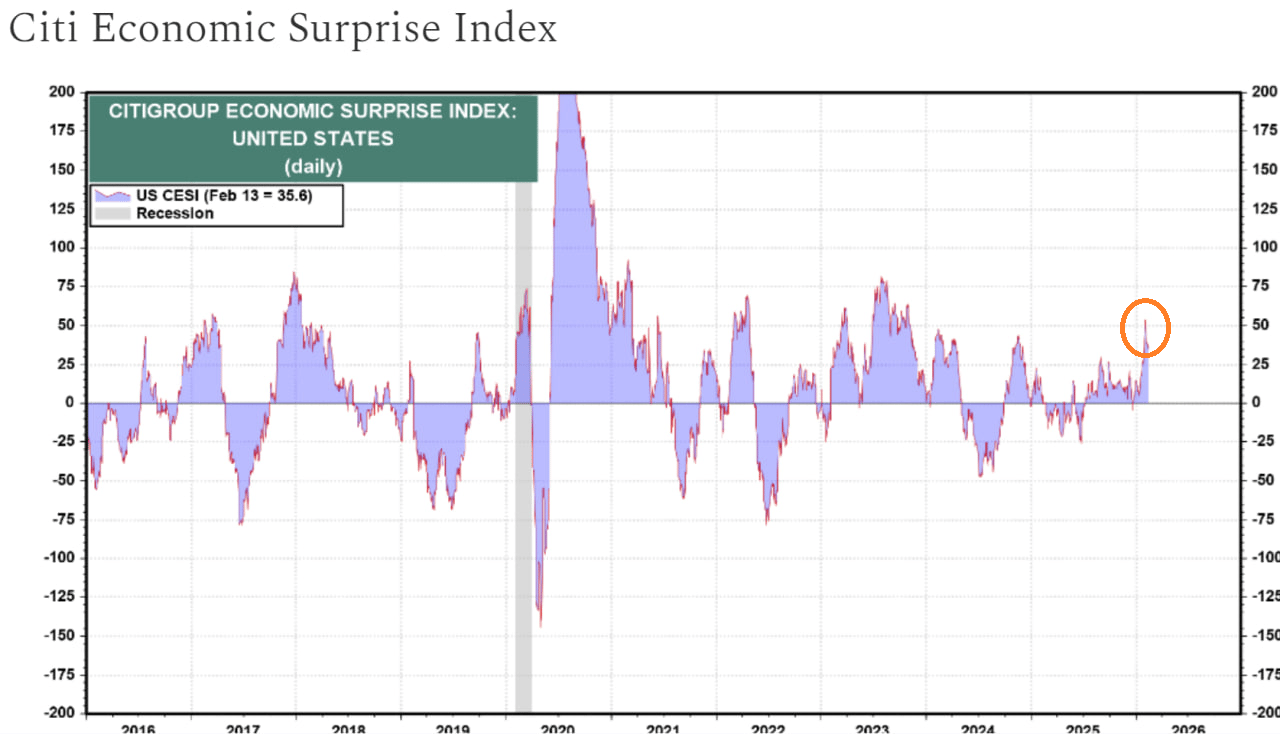

Markets Have Now Priced in Goldilocks

At the same time, Markets have now come around to our view that we have a Goldilocks economy. Take a look at one of my favorites, the Citi Economic Surprise Index.

That spike? That’s when markets realized the economy is good. And, it started to price in inflation concerns.

What’s rallying? Commodities, energy linked names, and consumer staples.

Markets

There Were Signs

SPY had three red days this week. Did you see it coming?

There were signs

1. Shay Boloor took the opportunity to dump on his followers citing paying for his marriage as rationale

These stocks are down massively.

2. A prominent SoFi booster got a job at SoFi and went dark.

This is ‘narrative cover’.

A convenient way to dump shares and not disclose.

SoFi is in a bear market.

3. Fortress and Citadel invest in XRP venture deal at a stupid valuation.

4. A bunch of non-bankers with no experience in Lending start a bank called Erebor at a stupid valuation.

5. Dozens and dozens of crypto DATs went public.

The vast majority of these tokens solve no real world problem.

6. IPO Season Fatigue

A deluge of IPOs hit the market.

Many drop below IPO price, burning investors and dampening animal spirits.

7. Robinhood offers a first of its kind pre-IPO deal (Figma) at a stupid valuation.

If promptly tanks 80%. (Figma still has a 100X PE ratio.)

8. Competing ‘thematics’ - drones, robotics, AI, crypto - fragment attention markets.

SPACs proliferate fragmenting focus in a marketing frenzy.

9. Economic populism - on the banks, on pharma, on housing, on private equity, on defense stocks - hurts confidence.

10. Sam Altman states that he has $1 Tn in capex spending obligations… and he’s got hundreds of billions in RPOs (eg, debt) and equity all over the tech system.

If you read our newsletter two weeks ago, you’d remember I flagged the incremental negative news.

The Dow Jones is making new highs - atoms and materials - not bits and bips. Value is beating growth.

The Nasdaq continues to lag vs Small Caps and the Dow Jones:

I also continue to find people that are trying to ‘buy the dip’ on two to three year old themes… when these themes appear to have broken in unison.

They are going to give back their unrealized gains.

The key suggestion here is : Rotate, Rotate, Rotate.

Another… I noticed we bought Coupang and Software too early. They failed to bounce where they are supposed to.

And, plenty of names are doing the same: Amazon is below the 200 DMA, Microsoft is under pressure, Netflix is in a bear market, Apple’s chart looks terrible, and Tesla is in a downtrend. (We have a short on Tesla now.)

The general point: when stocks fail to bounce at key technical levels, that’s the market giving you a key signal.

It’s not that we were “right or wrong” to buy Coupang and Software at those times. The process said it made sense. But, now we are getting market feedback that we are in a new regime.

The last time we saw this phenomenon was in March of last year during the tariffmageddon.

I do think the risk of a potential correction is heightened.

The S&P we believe will struggle to get over 7,000.

What’s working? Commodities and memory stocks. But, aren’t they the same trade? Compare these two charts (MU and Silver).

Now, doesn’t DRAM use Silver as an input? How can both of these continue to go up?

Isn’t it the case that these are both rallying on momentum? And, perhaps that momentum is getting crowded?

Remember what happened to Hershey’s when Cocoa prices went thru the roof?

How can both of these go up together?

All to say, there are imbalances in markets, and markets will correct these in my view.

The fundamental imbalance is ‘Crowdedness’.

That’s why I believe we’ll see many KOLs lose reputation this year. It’s not that they are ‘right or wrong’ on some fundamental thesis.

It’s that they have caused crowdedness. How do you flip on a thesis you’ve been pounding the table on for so long?

I don’t think these KOLs can step out of their own bubble and do so. And the pressure from their ‘tribe’ for doing so would be like a scalping.

Look at the pressure Nic Carter faces from the bitcoin community.

Who are these KOLs? Cathie Wood, Michael Saylor, Tom Lee, and several tribal leaders on twitter who are pushing quantum stocks, Robinhood, and Palantir.

The AI Apocalypse Trade

Markets are looking at AI as an asteroid that will kill any industry that comes remotely close to AI implementation.

We saw several examples this week.

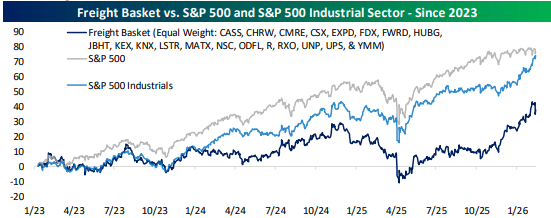

1) The first was trucking companies.

C.H. Robinson (CHRW) fell 15% and Expeditors (EXPD) fell 12.5% in a single session.

It occurred after Algorhythm Holdings announced they have developed an AI tool which can help scale Freight without increasing headcount.

Investors rushed out from legacy players into the the AI product, causing Algorhythm Holdings (RIME) to gain 79% on announcement.

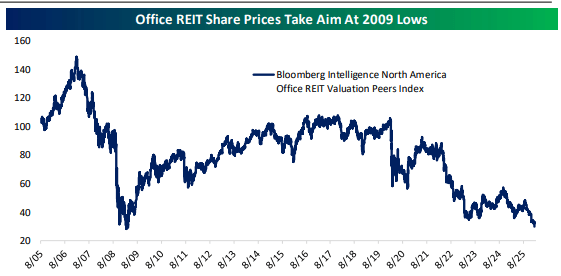

2) We saw a similar scare in Office REITs (notice how far the effects are spreading).

The sector hasn’t caught a break since COVID, but the fall narrative has evolved from “work-from-home” to “AI reduces white-collar headcount.”

The category is now trading at 2009 lows.

3) Financial services also got the hit from a similar scare.

Altruist introduced ‘Hazel’, an AI platform to automate and streamline traditional advisor services.

This caused a sharp sell-off in any financial company that had a large team of advisors- LPL Financial was down 12%. Charles Schwab dipped 7%, and even Morgan Stanley lost ~3%.

Financial Services ETF (IYG) slipped below its 200-day moving average after the news.

We are already seeing the worst scare in software names, with IGV having lost over ~35% of its valuations in the last 1Y.

Overall, we believe the sentiment around the AI scare is overblown now.

AI implementation isn’t like “flipping a switch”. Companies have embedded workflows that will need to be replaced.

Users have inertia in learning and execution, which leads to higher switching costs.

AI will get implemented eventually, but it would involve legacy systems integrating AI within existing processes.

This will mean existing providers improve prices, costs and productivity rather than them losing customers.

We are already seeing it in software names, where AI is now actively integrated in the primary offering.

Hubspot Earnings: AI fears are Overblown

HubSpot’s latest quarter came in strong: sales and earnings grew ~20% YoY, and margins held firm at 18%. Customers count also grew by 16%

The earnings tell us exactly what happens to SAAS after AI.

Hubspot’s net revenue retention rose to 105%. This means existing customers are spending more with the company.

Unlike market fears, customers are not leaving Hubspot for AI providers.

Instead, businesses are adding more seats and more products to their existing contracts.

The Reason?

HubSpot is providing the AI features customers want inside the products they already use.

Yamini Rangan (CEO) emphasized that they have “embed AI across the platform,” making it part of daily user workflows rather than a standalone tool.

Customer usage data supports that view.

HubSpot said “50% of Core Seat users have tried and are using [the AI assistant].”

This shows AI is becoming part of SAAS rather than replacing it.

We believe this is exactly how AI gets adopted at a larger scale – legacy providers will integrate AI within their offerings, so customers can easily use AI offerings without any switching costs.

We added to Hubspot post-earnings, and they were up 6.5% on Friday.

The fundamental business is solid, growing double digits with operating margins at ~20%.

They are gaining share against Salesforce. Lumida has also recently transitioned to Hubspot for our marketing activities.

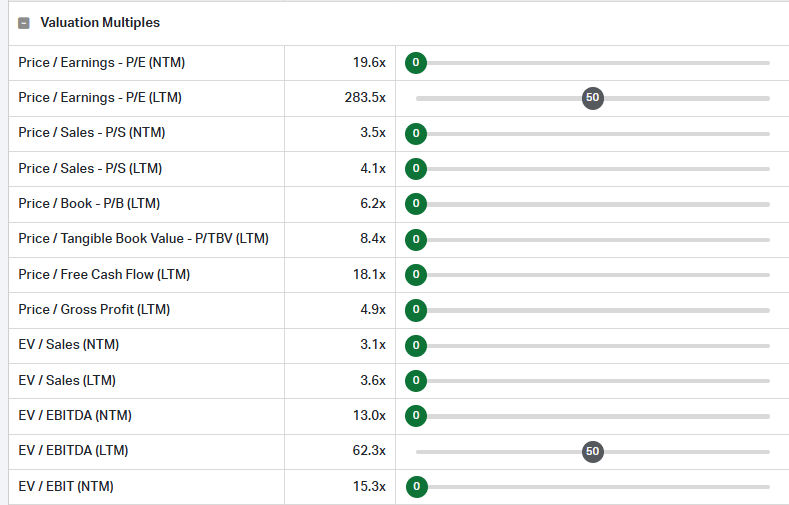

The valuation metrics on HUBS have also never been cheaper.

Investors Are Positioning For Cash

Since Nov, we have been talking about rotation out of growth, and into cash-rich, high value assets.

The data makes it clear.

Dividend-paying stocks are decisively outperforming year-to-date, while companies with no dividends are lagging.

The same pattern appears across valuation metrics: stocks with lower price-to-sales ratios are outperforming the highest-multiple names.

This highlights investors are moving away from expensive growth exposure to better valued companies.

High-dividend and value-oriented names offer earnings visibility, free cash flow support, and downside protection at a time.

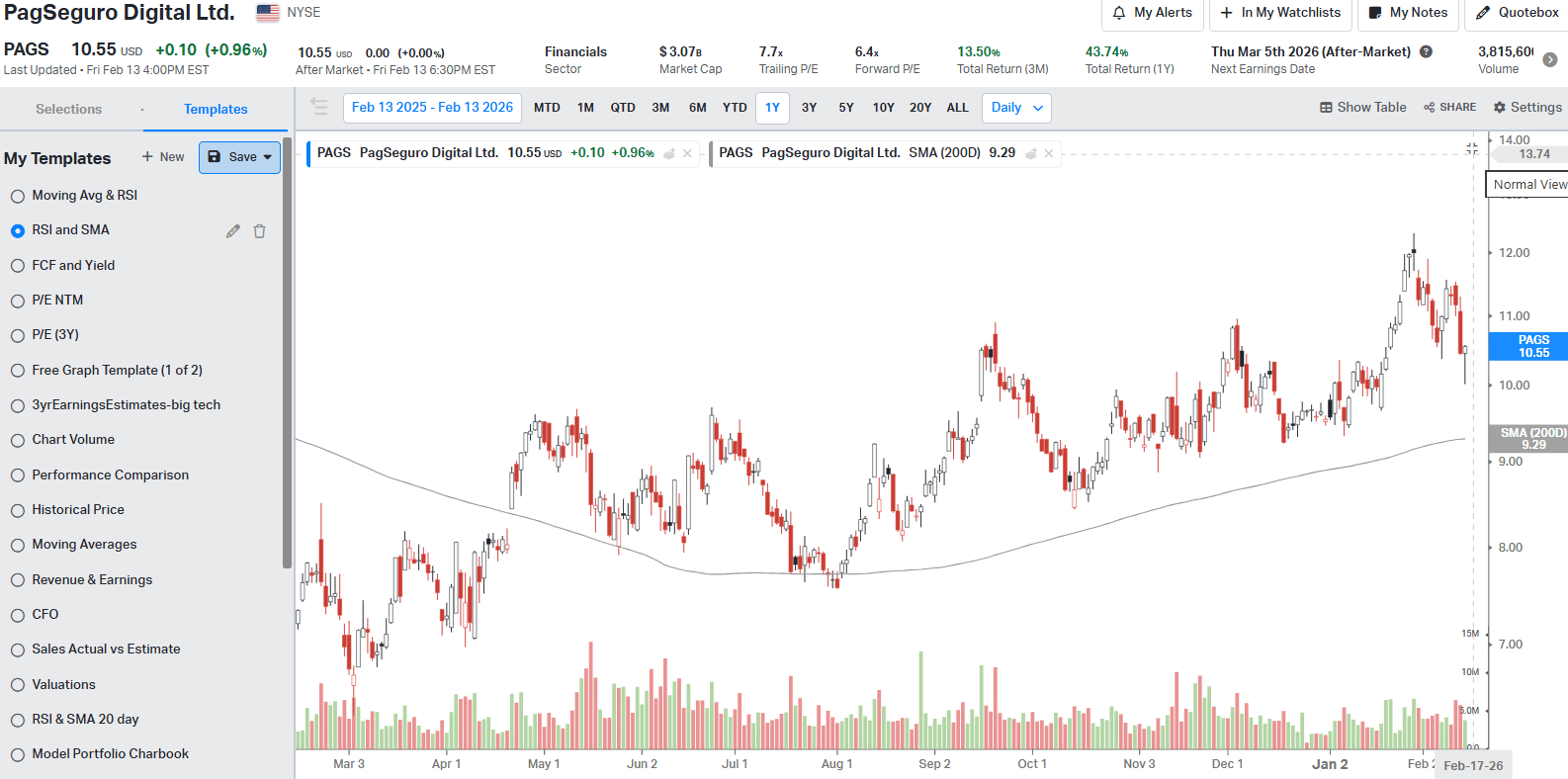

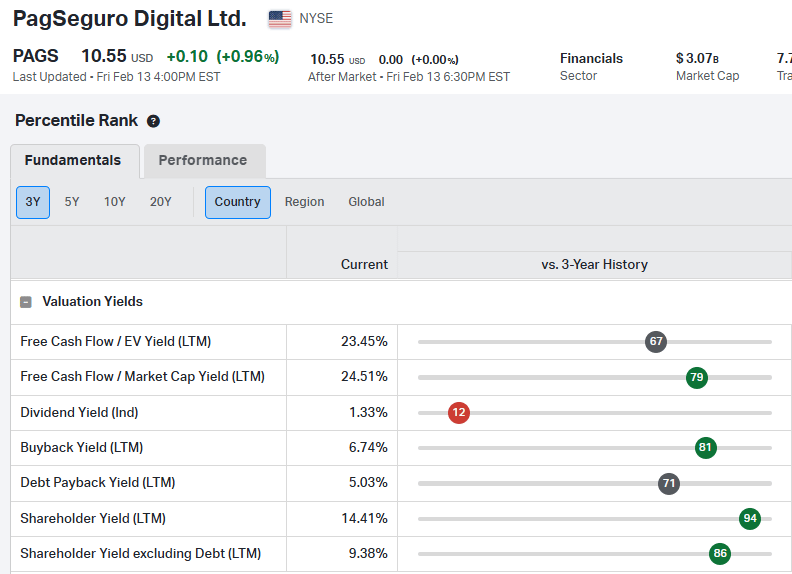

PAGS was a Lumida 2026 pick with a dividend yield of ~11%. The stock’s up about 14% in 2026. We added to it on Friday.

PAGS has evolved from a payments processor into a full-stack fintech platform serving Brazilian SMBs and consumers through PagBank.

Payments remain the entry point, but the real value sits in the attached banking services: deposits, secured credit, insurance, and investments.

That ecosystem has allowed PagSeguro to grow earnings while many global fintech peers have struggled with funding costs and margin compression.

PAGS trades at roughly 6.4x forward P/E, and under 1x sales. It generates exceptionally high free cash flow, with FCF yields north of 20%.

Margins remain strong, with EBITDA margins in the mid-40s, and high operating leverage.

Management has been conservative, focusing on secured lending and prioritizing profitability over aggressive market share gains.

That has kept losses contained even as Brazilian rates stayed high.

As rates are expected to normalize, operating leverage could surprise to the upside.

The risk is clear: Brazil remains competitive and macro-sensitive. The competition from Nubank and StoneCo can also hurt long-term growth.

But at today’s valuation, the market is already pricing in a lot of bad news.

More Trouble For OpenAI

OpenAI’s troubles have become a regular feature for this newsletter, and this week wasn't any better for them.

Anthropic has planned to raise $30B at a valuation of ~$380B in Series G.

While this raise will further enhance their ammo against OpenAI, the more concerning report was how they are already winning market share.

Business adoption is no longer moving in OpenAI’s favor.

Ramp data shows overall business AI adoption hit 46.8% in January, but Anthropic penetration rose to 19.5% (from 16.7%) while OpenAI dipped to 35.9%.

Roughly 79% of Anthropic customers also pay for OpenAI, and 16% of businesses now use both platforms, up from 8% a year ago.

That points to a buyer mindset change. They are no longer just using OpenAI, but are exploring other options alongside it.

That weakens OpenAI’s leverage in renewals and pricing, because it is easier for customers to shift workloads when outcomes look comparable.

On the consumer side, Gemini has a structural distribution edge.

Users do not need a migration plan. They just click what is already embedded in Google’s workflow.

That kind of default placement reduces inertia and can quietly drain usage, even if OpenAI’s product is strong.

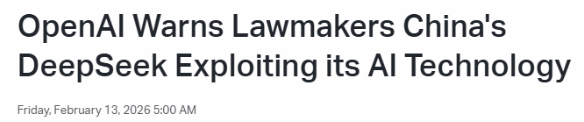

Then, there is DeepSeek.

OpenAI reportedly warned U.S. lawmakers that DeepSeek is attempting to reverse engineer its models.

It says they are using distillation methods to bypass access restrictions through masked routing.

If that dynamic persists, we might see more competitors with similar capabilities flooding the market. This will accelerate commoditization, and hurt pricing power.

OpenAI now faces a twin squeeze: softer demand power from multi-vendor adoption, and higher competitive pressure from lower-cost models.

Things aren’t looking good for OpenAI.

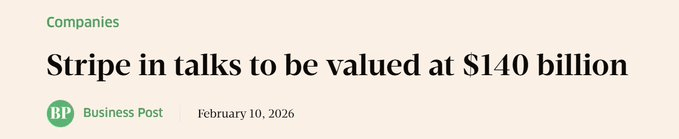

The Bubble In Venture Capital

Stripe is expected to raise at $140 Bn

Stripe raised at ~$86 Bn valuation at a top of the market round in 2021.

Adyen, a fintech darling, peaked at $32 in 2021.

It dropped 24% this week alone and is now at ~$11.

Adyen is down 65% over the last 5 years in public markets - along with every single payment stock.

Stripe is up 62% over this time frame... even as competition intensifies from Tempo, Circle, etc.

Do you really think Stripe is worth $140 Bn?

Maybe it's worth $40 Bn?

Trading As Gambling?

Robinhood users have made very little money since the meme-stock era ended.

We see some spikes during the risk-on phase, but sharper drawdowns every time.

It’s usually the same for other retail trading platforms.

These apps are optimized for trading - the more traders trade, the more money the app makes.

The AI apocalypse is coming for RobinHood, SoFi, and the legacy wealth management complex.

And, Lumida is leading the charge.

Lumida Copilot is not designed to maximize clicks or trades. It is designed to help investors think.

Users get AI bull/bear indicators, structured theme views, and institutional-style positioning signals — tools that show when the wind is at your back or in your face.

The goal is simple: have an informed AI partner for your everyday investment decisions.

Check out this feedback from users testing the Lumida Invest App

Sometimes You Can Just Do Things.

If you’d like to get on our external testers list, sign up here. (It’s free!)

Lumida Curations

The AI Ads Debate Goes Public

A fresh exchange between Sam Altman and Anthropic highlights a growing divide over whether advertising belongs inside AI products — and what that means for user trust, privacy, and future monetization.

AI Agent “Taught Itself” a New Skill

An anecdote from OpenClaw’s founder describes an AI agent independently figuring out how to process voice input. This shows how fast autonomous AI capabilities are evolving beyond their original design.

Olive Oil Is the Anti-Inflammation Hack

New evidence suggests that moderate daily intake of extra virgin olive oil can produce mild anti-inflammatory effects, supporting joint health and recovery through mechanisms similar to common pain-relief pathways.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.